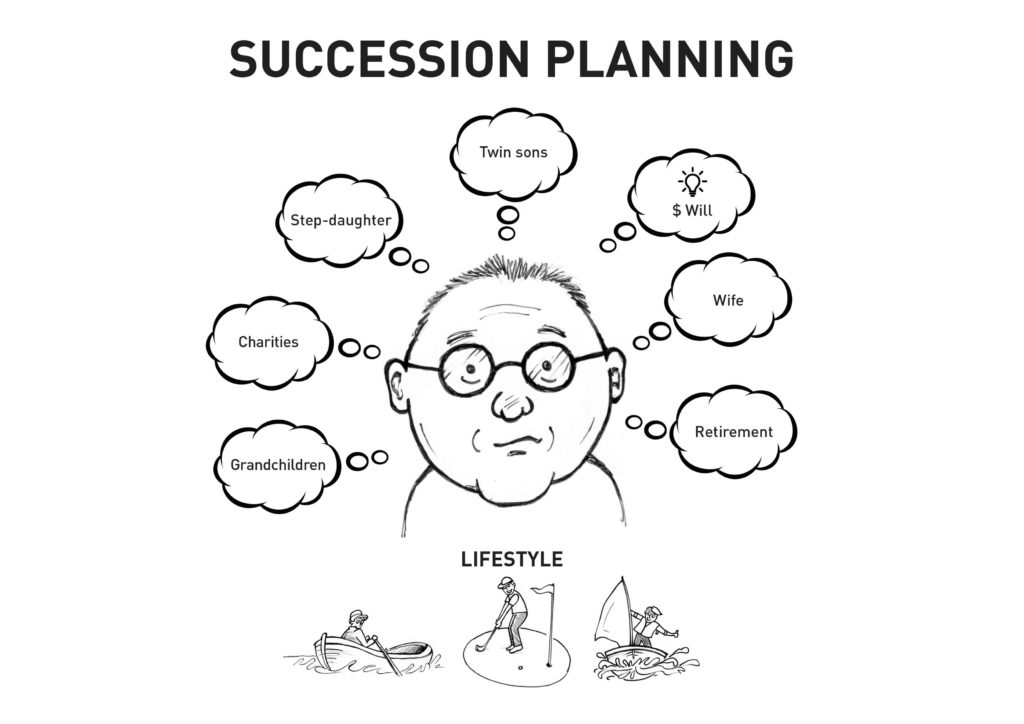

SUCCESSION PLANNING

Personal Succession Planning.

On a personal level, succession planning is an in-depth look into one’s financial position within the context of one’s family. It is the legacy you will leave to your family that embraces your life’s work. In this context we look at your Wills, Power of Attorney and Appointment of Guardians. We also get you to consider whether you wish to create testamentary trusts in your Wills and whether you also wish to create living trusts to protect your assets and give you maximum taxation advantages during your lifetime.

Business Succession Planning.

On a business level, succession is the process whereby a business is passed on or sold to family members or senior management.

We look at the current situation and help you to understand this process. It is a complicated process and requires detailed planning both in terms of business control issues and pay-out strategies so that essentially the integrity of the business is preserved and your financial pay-out for handing over or selling all or part of the business is secure.

In succession planning, detailed discussions take place with all family members both individually and collectively. The ability of each family member willing to join the family business is scrutinised and evaluated according to specific skills, training and education. Processes are put in place and time-lines are drawn up for implementation. This process can take a number of years to complete and detailed documentation is required at each stage. Ultimately, the vision of the incoming members of the family will strongly influence the future direction of the business.